23+ Ss retirement estimator

You can build and maintain a holistic financial plan. What is the one thing you can do today to ensure better financial decision making habits and outcomes.

2

These FAQs address specific issues related to the deferral of deposit and payment of these employment.

. You had the equivalent of 2804 years of maximum so your CPP was approx. 2021-33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the employee retention credit. Early Termination of the Employee Retention Credit for Most Employers-- 23-NOV-2021.

Form W-2G Certain Gambling Winnings. Its been over 15 years since I did my first review of their platform. Instructions for Form SS-4 Application for Employer Identification Number.

It usually takes about 2 weeks to get an SSN once the SSA has all the. The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer the deposit and payment of the employers share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes. Virgin Islands Guam American Samoa and the Commonwealth of the Northern Mariana Islands.

With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. It cant be filed by the employer. You can also view retirement benefit estimates by.

This product feature is only available after you finish and file in. Available in TurboTax Self-Employed and TurboTax Live Self-Employed. ASCII characters only characters found on a standard US keyboard.

If you used an EIN including a prior owners EIN on Form 941-SS that is different from the EIN reported on Form W-3SS see Box hOther EIN used this year in the General Instructions for Forms W-2 and W-3. Statements of Michael J. Social Security and OIG Establish New Anti-Fraud Units.

Instructions for Schedule H Form 1040 or Form 1040-SR Household Employment Taxes. Wage and Tax Statement Info Copy Only. Form SS-4 Application for Employer Identification Number.

Astrue Commissioner of Social Security and John P. Your monthly benefit amount will be different depending on the age you start receiving it. Retirement tax help and IRA tool show you how to get more money back this year and when you retire.

Filed Form SS-8 with the Internal Revenue Service Office in Holtsville NY. Circular SS - Federal Tax Guide for Employers in the US. Melville New York State Police Acting Superintendent on.

How does an employer report Additional Medicare Tax on Form 941 Form 941-PR or Form 941-SS. You can get Form SS-5 from the SSA website at SSAgovformsss-5pdf at SSA offices or by calling 800-772-1213 or 800-325-0778 TTY. September 23 2019.

On the Form 1040X you file do not complete lines 1 through 23 on the form. Form 8915A Qualified 2017 Disaster Retirement Plan Distribution and Repayments. Do I make a separate payment.

Retirement Plans for Small Business SEP SIMPLE and Qualified Plans 560 EPUB. In 2014 the IRS issued Notice 2014-21 2014-16 IRB. Form SS-5 is available at any SSA office on the Internet at SSAgovformsss-5pdf or by calling 800-772-1213.

Enter the smaller of line 19 or. So I reached out to their team to get some updates on their growth. Filing a Form 941-SS with an incorrect EIN or using another businesss EIN may result in penalties and delays in processing your return.

Write Protective Claim at the top of the form sign and date it. Social security and Medicare taxes fund retirement survivor disability and health benefits for workers and their families. In addition enter the following statement in Part III.

Line 5d has been added to Form 941 Form 941-PR and Form 941-SS. Dec 2017 Oct-18-2018. Must contain at least 4 different symbols.

795 of the maximum for someone your age. Our divorce became final in May 2014. The frequently asked questions FAQs below expand upon the examples provided in Notice 2014.

If youre not filing a 2021 tax return file Schedule H by itself. 6 to 30 characters long. As of this date April 10 2015 he has not done that although he did pay estimated quarterly taxes.

Form SS-4 Application for Employer Identification Number. At age 605 your best 35275 years are used to calculate your CPP. Schedule B is filed with Form 941 or Form 941-SS.

Use this address if you are a taxpayer or tax professional filing International for Form 1040. Form 944 allows small employers 1000 or less of annual liability for Social Security Medicare and withheld. If you have any questions about which documents you can use as proof of age identity or citizenship contact your SSA office.

If you choose to start your benefits early they will be reduced based on the number of months you receive benefits before you reach your full retirement ageIf you wait until full retirement age your benefits will. Instructions for Form CT-1X Adjusted Employers Annual Railroad Retirement Tax Return or Claim for Refund. Information about Form 944 Employers Annual Federal Tax Return including recent updates related forms and instructions on how to file.

You can get Form SS-5 online at SSAgovformsss-5pdf from your local SSA office or by calling the SSA at 800-772-1213. And one way to do that step-by-step is using the NewRetirement Planner. References to Form 941 in these instructions also apply to Form 941-SS Employers QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and.

Correction to the Instructions for Form 941-SS Rev. The longer you wait the higher the amount of the benefits. 938 PDF explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency.

Your personal my Social Security account gives you secure access to information based on your earnings history and interactive tools tailored to you. Feb 2014 May-01-2014. On this line employers report any individuals wages paid during the quarter that is in excess of the 200000 withholding threshold for the year as well as the withholding liability.

As part of the divorce decree my husband was ordered to file the joint return taxes for 2013 by August of 2014. To apply for an SSN fill in Form SS-5 and return it along with the appropriate evidence documents to the Social Security Administration SSA. Each of our two daughters lives with one of us- they are ages 22 and 23 each with a baby.

Where to File Form 1040NR 1040PR and 1040SS Addresses for Taxpayers and Tax Professionals filing international during Calendar Year 2022. File Schedule H with your Form 1040 1040-SR 1040-NR 1040-SS or 1041. Form W-2 Wages and Tax Statement.

Social Securitys Online Retirement Estimator Available in Spanish at wwwsegurosocialgov December 10 2010. Retirees with low incomes or whose only source of income is Social Security generally dont pay income tax on their Social Security benefitThe average Social Security payment to retired workers. Based on this info your CPP retirement pension in 2014 should have been 57611 which is 14823 less than the 2014 maximum of 72434 for someone your age.

The employee must complete and sign Form SS-5.

![]()

23 Sample Expense Tracking Sheets In Pdf Ms Word

2

Free 9 Sample Social Security Request Forms In Ms Word Pdf

Guest List Templates 13 Printable Xlsx Docs Pdf Formats Guest List Template Wedding Guest List Template Wedding Guest List

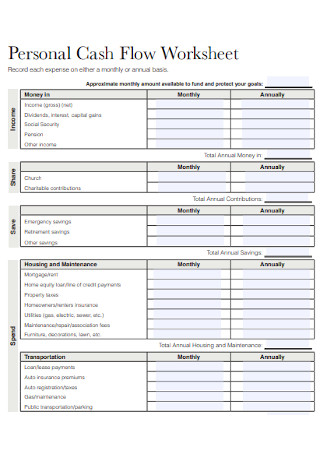

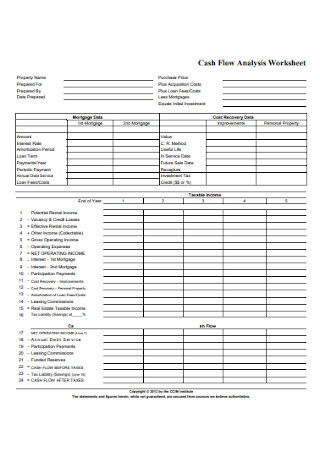

23 Sample Cash Flow Worksheets In Pdf Ms Word

2

23 Sample Cash Flow Worksheets In Pdf Ms Word

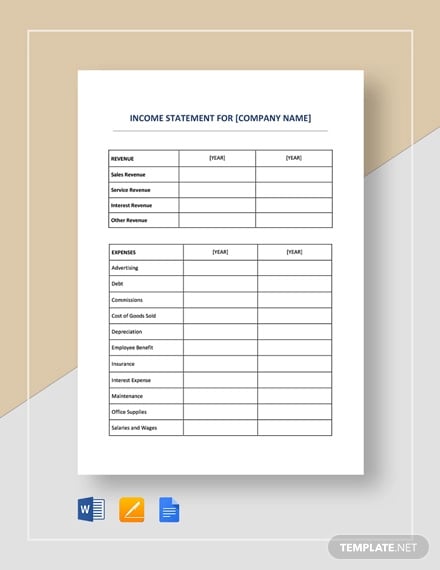

Income Statement Template 23 Free Word Excel Pdf Format Download Free Premium Templates

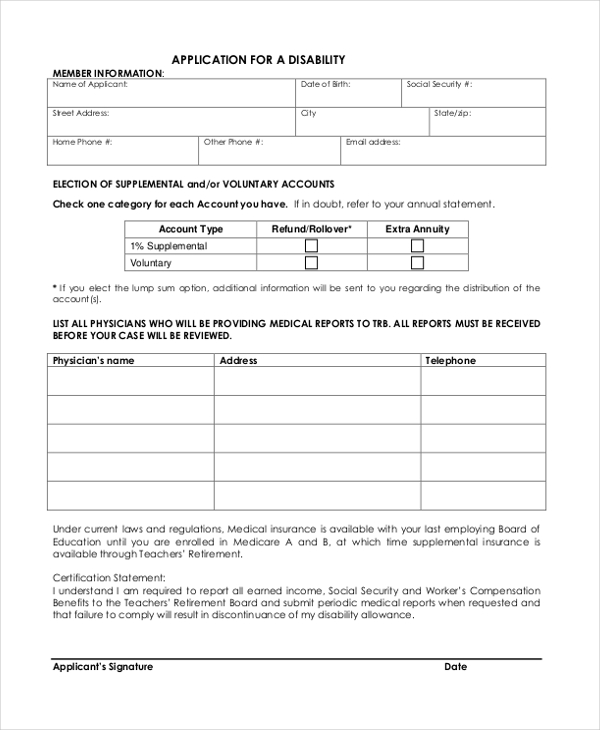

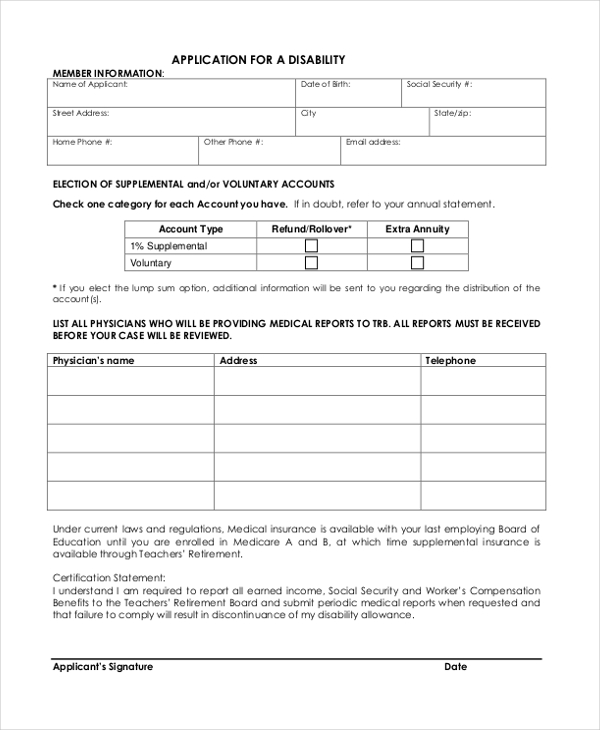

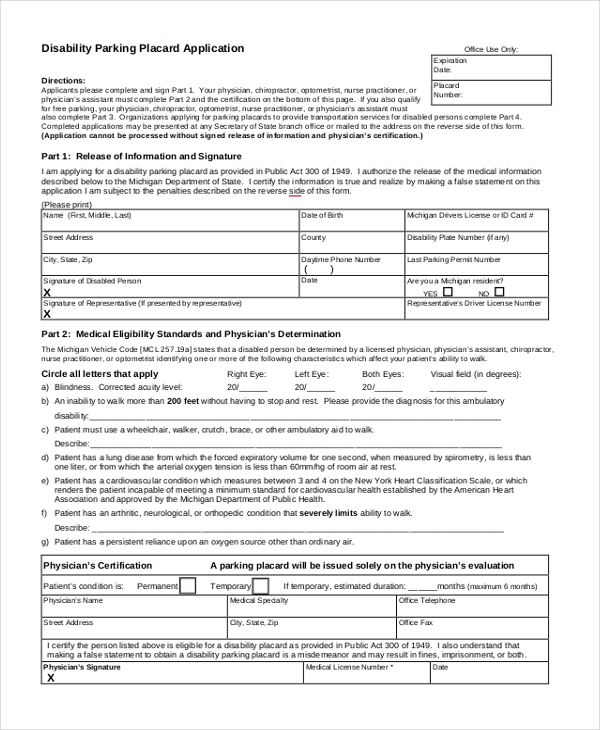

Free 23 Sample Disability Forms In Pdf Word Excel

23 Sample Cash Flow Worksheets In Pdf Ms Word

![]()

23 Sample Expense Tracking Sheets In Pdf Ms Word

![]()

23 Sample Expense Tracking Sheets In Pdf Ms Word

Income Statement Template 23 Free Word Excel Pdf Format Download Free Premium Templates

Free 23 Sample Disability Forms In Pdf Word Excel

Free 9 Sample Social Security Request Forms In Ms Word Pdf

2

2